The Austrian Financial Markets Authority, FMA, published a complete guide on ICOs. It follows a prior analysis on its "2018-2023 strategy report" and similar efforts of other regulators.

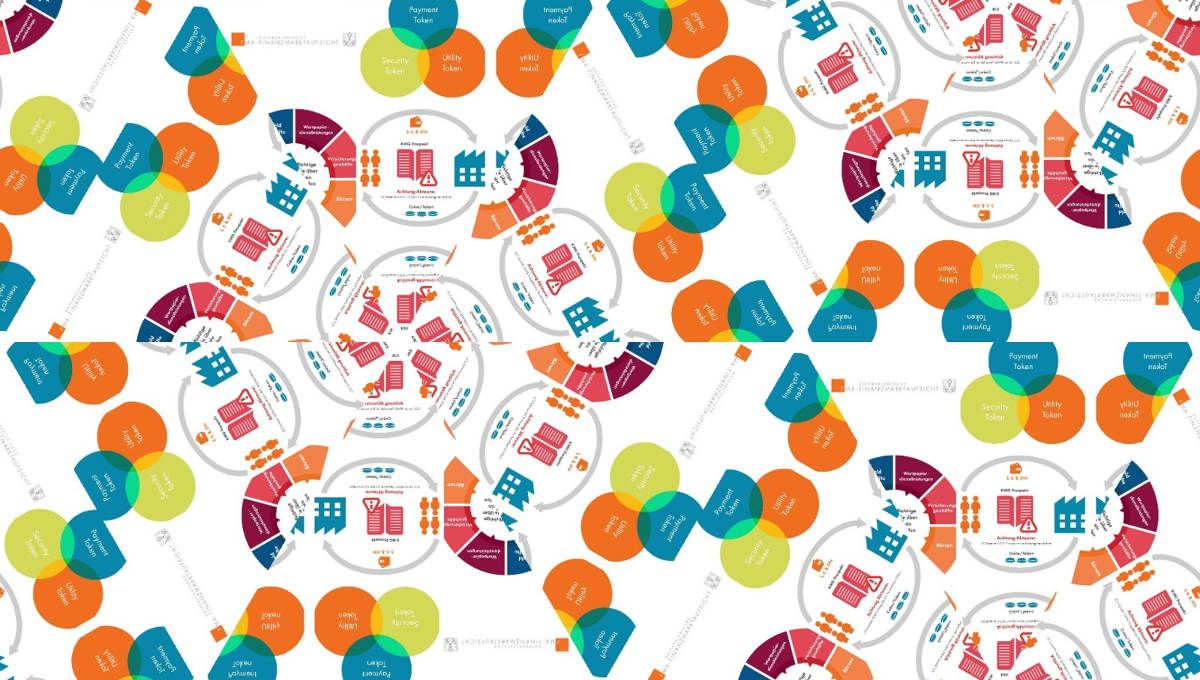

The FMA considers that the qualification of the operation of selling a cryptocurrency for a new project must be considered on a case by case basis. It acknowledges that the tokens sold in order to raise capital may have different nature:

- Security tokens that confer a right to the buyer. They might imply licensing requirements and prospectus regulations under European regime and and Austrian specific laws (c.f. below)

- Payment tokens that allow to pay for a service. They might trigger a licence requirement (E-money, PSD2, or banking)

- Utility tokens that are connected to a particular product or service. The FMA seems to recognize the possibility of novel schemes ( co-design, social, ... ) but reminds that if it is used for payment or investment functions, usual regulations might apply

Main potentially applicable regulations in Austria:

- Bank Act (1993) ( Deposit licence may be required, issuance and management of means of payment regulation, licence for custody services ... )

- Securities supervision Act of 2018 ( transcription of MiFID2)

- Austrian Capital Market Act (1993)

- E-Money & Payment Services Act of 2010 & 2018 transcribing the corresponding european directives

Only the German version of the FMA guide is available at the moment. A short document on ICOs from an investor protection perspective is available in english.